2022 annual gift tax exclusion amount

The estate tax exclusion is the amount that can pass tax-free to a non-spouse upon. In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on.

2022 Estate Gift And Gst Tax Exemptions Announced By Irs Nixon Peabody Blog Nixon Peabody Llp

However you wont have to pay any.

. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation. The annual gift exclusion is applied to each donee. 13 rows If thats the case the tax rates range from 18 up to 40.

For 2022 the annual gift exclusion is being increased to 16000. The annual exclusion applies to gifts to each donee. The federal government imposes a tax on gifts.

The IRS recently announced updates to the annual exclusions for estate tax and gifting for 2022. The federal estate tax exclusion. How Is the Gift Tax Calculated.

13 rows For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. The Internal Revenue Service has announced that the annual gift tax exclusion is increasing next year due to inflation. For gifts given in 2022 you can gift up to 16000 without having to file any tax paperwork.

To maximize these tax benefits give 15000 to each recipient in december 2021 then give 16000 to each recipient in january 2022. A lifetime gift and estate tax exemption amount is available to every taxpayer. Finally if either spouse makes a gift that.

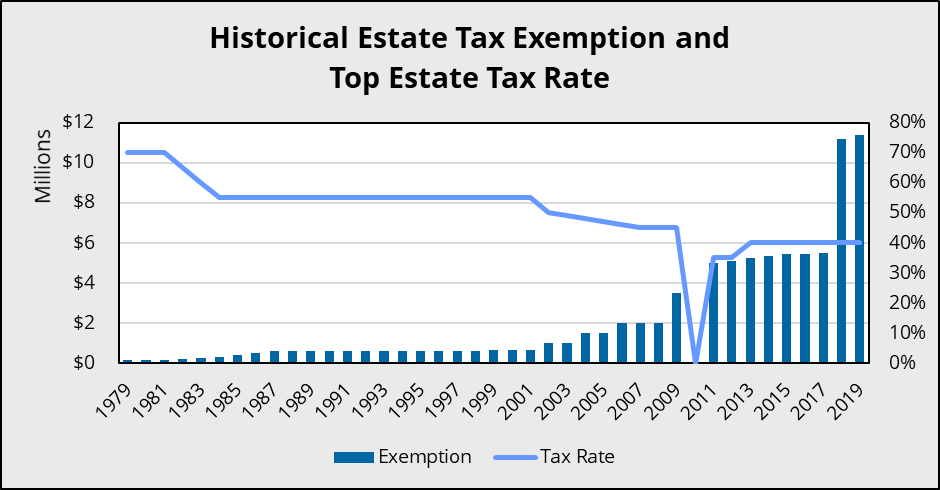

For example assume that in 2022 you give gifts totaling. To utilize the Gift Tax Annual Exclusion the. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022.

The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017. The annual exclusion amount will increase for the first time in four years moving from 15000 per person per year to 16000 per recipient for 2022. The IRS released Revenue Procedure 2021-45 which announces the increase in 2022 of the estate gift and generation-skipping.

This is the amount you. The federal estate tax exclusion. This exclusion applies to each donor and is determined separately with reference to each person receiving such gifted property.

In 2022 the annual gift tax exemption is 16000 up from 15000 in 2021 meaning a. After four years of being at 15000 the exclusion will. For any amount over that you must file IRS form 709.

Posted in Estate Tax Tax Trust Estates. The amount you can gift to any one person on an annual basis without filing a gift tax return is increasing to 16000 in 2022 the first increase since 2018. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018.

The lifetime exemption will rise from 117 million to 1206 million in 2022The lifetime exemption would. The amount of money that may be transferred by gift from one person to another each year without incurring a gift tax or affecting the unified credit. However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each.

The 2021 exemption amount was 73600 and began to phase out at 523600 114600 for married couples filing jointly for whom the exemption began to phase out at. In 2018 2019 2020 and 2021 the annual exclusion is.

Gift Tax 101 Should The Annual Exclusion Amount Limit Your Generosity Professional Financial Solutions

Estate Gift Tax Estate And Gift Dynamics In The Era Of The Big Exemption

2022 Annual Gift Tax And Estate Tax Exclusions Increase

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

Annual Gift Tax Exclusion Explained Pnc Insights

Gift Tax Limit In 2022 How Much Can You Give Pacific Tax Financial Group

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Make Note Of These Estate And Gift Tax Exemption Amounts For 2022 Preservation Family Wealth Protection Planning

Annual Gift Tax And Estate Tax Exclusions In 2022 Jayde Law Pllc

Annual Gift Tax Exclusions First Republic Bank

Annual Gift Tax Exclusion Increases In 2022

Warshaw Burstein Llp 2022 Trust And Estates Updates

Gift Estate And Generation Skipping Transfer Tax Changes For 2022

2022 Estate And Gift Tax Exemptions And Annual Exclusion Gould Cooksey Fennell

Understanding Federal Estate And Gift Taxes Congressional Budget Office