virginia estimated tax payments due dates 2021

And those dates are roughly the same each year the 15th of April June September and the following January. Rickie Fowler changed caddies before his last start of the 2021-22 PGA Tour season and hes moving on from his swing coach too.

The corporation must use electronic funds transfer to make installment payments of estimated tax.

. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000. These were as follows for 2021 Taxes these deadlines have passed. For the 2022 tax year estimated tax payments are due quarterly.

No individual income tax. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning. Corporations subject to Virginia income tax may need to file a one-time report with Virginia Tax by July 1 2021.

If the due date falls on a Saturday Sunday or holiday you have until the next business day to file with no penalty. The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. Corporate and Individual Income Tax Conformity Dates of Static Conformity States.

The maximum amount you can elect to deduct for most section 179 property including cars trucks and vans you placed in service in tax years beginning in 2021 is 1050000. Penalties may apply if the corporation does not make required estimated tax payment deposits. 2021 Tax Return.

2021 PA Realty Transfer Tax and New Home Construction Brochure. 11597 text is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act TCJA that amended the Internal Revenue Code of 1986Major elements of the changes include reducing tax rates. According to a report released by Fair Tax Mark in 2019 Amazon is the best actor of tax avoidance having paid a 12 effective tax rate between.

Estimated Tax Due Dates for Tax Year 2022. 2021 Property Tax Rent Rebate Program Information. Fall enrollment deadlines are June 5 2021 5-month plan July 5 2021 4-month plan and August 5 2021 3-month plan.

Estimated Income Tax Payments for Individuals. Hernández was due to hit free agency this winter and was. Due Dates for 2021 Estimated Quarterly Tax Payments.

In 20112012 it temporarily dropped to 1330 565 paid by the employee and 765 paid by the employer. Flood risk changes over time due to weather patterns land development and erosion. The minimum penalty is 10 and the maximum penalty is 30 of the tax due.

Individual Income Tax Return. This report will show the difference between the amount of tax the corporation would pay if it filed as part of a unitary combined group and. Amazons tax behaviours have been investigated in China Germany Poland Sweden South Korea France Japan Ireland Singapore Luxembourg Italy Spain United Kingdom multiple states in the United States and Portugal.

April 15 2021 for income earned January 1 - March 31 2021. See Estimated tax penalty. Thursday April 15th.

226 525 705 and SB 320 enacted by 2021 Montana Legislature. Internal Revenue Code Conformity for Tax Years 2018 2019 and 2020 as of March 29 2021. Upcoming Events and Due Dates.

308 B maintaining. The estimated tax payments are due on a quarterly basis. Your state will also have estimated tax payment rules that may differ from the federal rules.

Taxes can be paid in a variety of ways including online by phone and by mail. How much to pay when payments are due and the various payment options available to pay. Reconcile your estimated payments by e-filing a 2021 Return.

2021 Tax Credit. See All Past Updates. The combined tax rate of these two federal programs is 1530 765 paid by the employee and 765 paid by the employer.

Late filing or late payment of the tax may result in the assessment of penalties and interest. You can request a payment plan for making tax payments. The spending primarily includes 300 billion in one-time cash payments to individual people who.

Common Tax Relief Forms. Guide to paying IRS quarterly estimated tax payments. Typically most people must file their tax return by May 1.

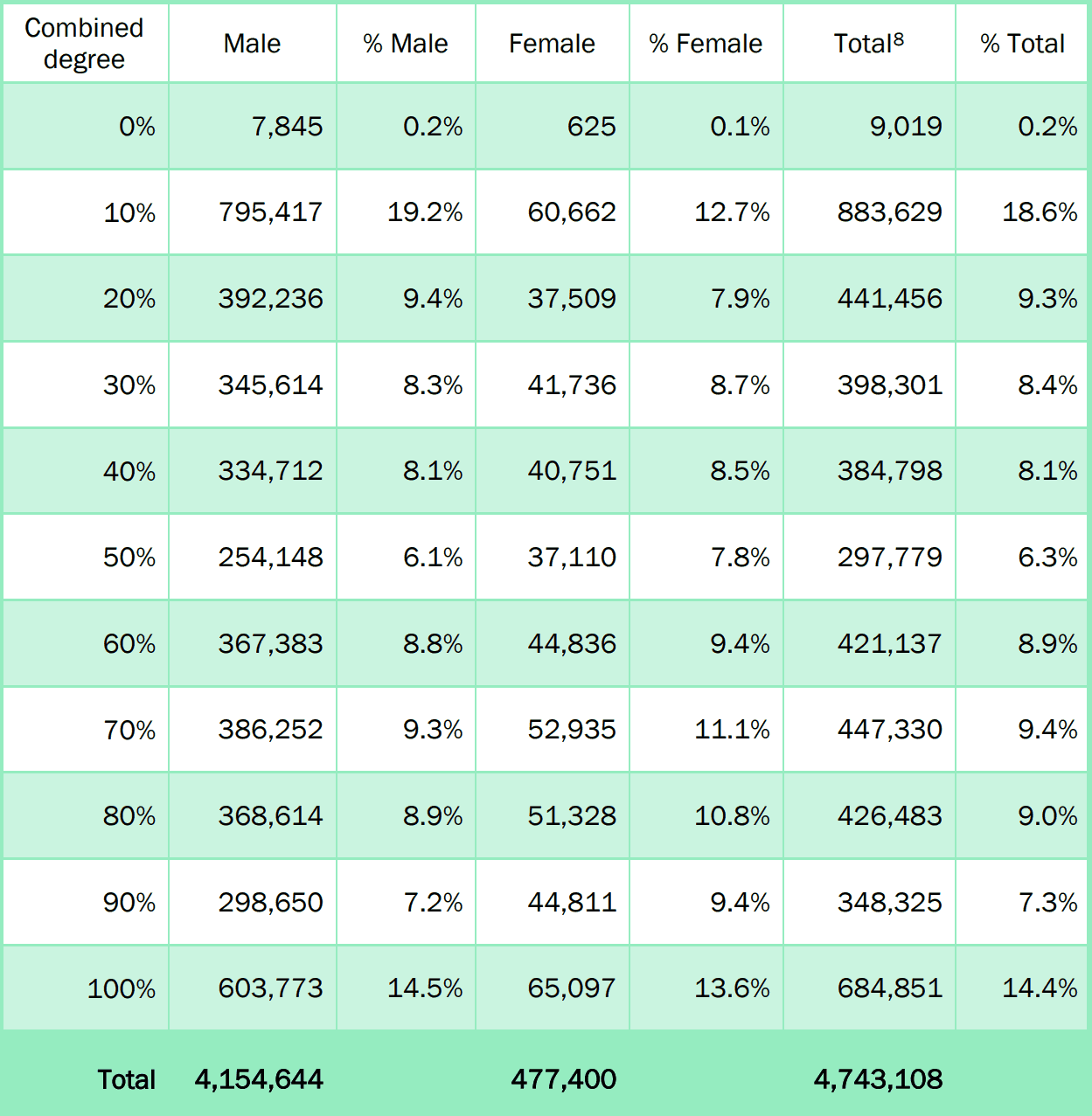

Utah adopts an 80 percent limitation as of tax year 2021. Payment Voucher for Individual Income Tax. You may pay your balance due in full by your due date instead.

Fill in the form save the file print and mail to the Indiana Department of Revenue. The Foreign Account Tax Compliance Act FATCA is a 2010 United States federal law requiring all non-US. Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID disease.

Use Form 1120-W Estimated Tax for Corporations as a worksheet to compute estimated tax. The Social Security tax rates from 19372010 can be accessed on the Social Security Administrations website. 4 Use of funds--An advance provided under this subsection may be used to address any allowable purpose for a loan made under section 7b2 of the Small Business Act 15 USC.

We have included the Regular Due Date alongside the 2022 Due Date for each state in the list as a point of reference. Department Rulemaking Filings for August 26 2022. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Income Tax Deadlines And Due Dates. The City collects car and real estate taxes maintains tax relief programs and assesses property values. The changes are likely to affect some residential and commercial property.

Friday January 15th 2021. See the Instructions for Form 1120-W. Each calendar year the state income tax due date may differ from the Regular Due Date because of a state.

Note that there is no payment plan available for the summer or January Term. Estimated Tax Voucher 2022 NJ Gross Income Tax Declaration of Estimated Tax form NJ-1040-ES Cut Along Dotted Line NJ Gross Income Tax Declaration of Estimated Tax NJ-1040-ES 2021 Calendar Year Due JANUARY 18 2022 Social Security Number required - 1 - OFFICIAL USE ONLY Voucher Check 4 if Paid Preparer Filed SpouseCU Partner Social Security. Indiana estimated income tax payment due dates are the same as the federal Form 1040-ES payment due dates.

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018 PubL. Overview of IRS Fresh Start. Foreign financial institutions FFIs to search their records for customers with indicia of a connection to the US including indications in records of birth or prior residency in the US or the like and to report such assets and identities of such persons to the US.

There is no requirement to use the international payment plan. What will happen if I file Form VA-6H or pay the tax due after Jan. In the table below you will find the income tax return due dates by state for the 2021 tax year.

Page one of the Indiana Form ES-40 file is the fillable voucher for the 2021 tax year. Pennsylvania Consumer Fireworks Tax Due Dates. Returns are due the 15th day of the 4th month after the close of your fiscal year.

2020 Pass-through Entity Returns on Extension Due. 636b2 including-- A providing paid sick leave to employees unable to work due to the direct effect of the COVID-19. 2022 Pennsylvania Wine Excise Tax Due Dates.

June 15 2021 for income earned April 1 - May 31 2021. Individual Income Tax Filing Due Dates. Section 179 deduction dollar limits.

Where S My Refund Virginia H R Block

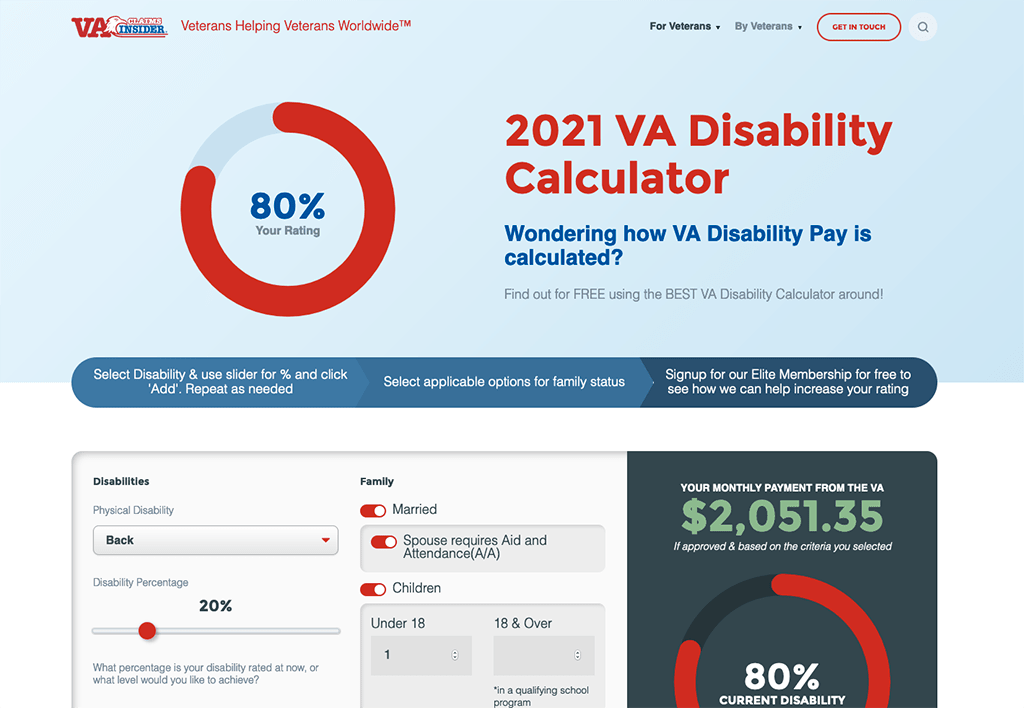

60 Va Disability Benefits Explained Va Claims Insider

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Pass Through Entity Tax 101 Baker Tilly

Common Va Entitlement Codes Definitions And Eligibility Requirements

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Va Disability Pay Dates 2021 With Va Pay Dates Calendar Va Claims Insider

Va Disability Payment Schedule For 2021 Cck Law

Virginia Dpb Frequently Asked Questions

Where S My Refund West Virginia H R Block

Virginia S Individual Income Tax Filing And Payment Deadline Is Monday May 2 2022 Virginia Tax

Treasurer Prince Edward County Va

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Va Termite And Pest Inspections List Of Requirements By State